Helbiz Announces Second Quarter 2022 Financial Results

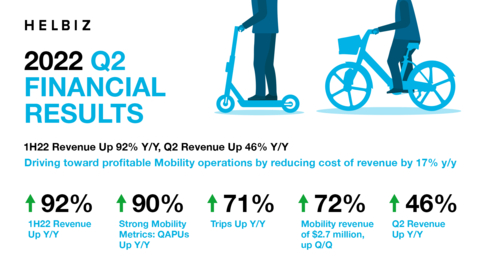

1H22 Revenue Up 92% Y/Y, Q2 Revenue Up 46% Y/Y

Strong Mobility Metrics: QAPUs Up 90% Q/Q And Trips Up 71% Q/Q

Helbiz Live and Kitchen Generate 44% of 1H22 Revenue vs. Zero in 1H21

Intense Focus on Cost Efficiency, Cash Preservation and Drive Toward Profitable Operations

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220815005631/en/

1H22 Revenue Up 92% Y/Y, Q2 Revenue Up 46% Y/Y Strong Mobility Metrics: QAPUs Up 90% Q/Q And Trips Up 71% Q/Q Helbiz Live and Kitchen Generate 44% of 1H22 Revenue vs. Zero in 1H21 Intense Focus on Cost Efficiency, Cash Preservation and Drive Toward Profitable Operations (Graphic: Business Wire)

Second Quarter and First Half 2022 Business and Financial Highlights

Financial

-

First half revenue of

$7.7 million , up 92% y/y -

Second quarter revenue of

$4.4 million up 46% y/y -

Raised

$10 million via new issue of convertible notes in the second quarter - Rationalized cost structure to more efficiently use cash and reduce future funding requirements

Mobility

- Quarterly Active Platform Users (“QAPUs”) up 90% q/q, Trips up 71% q/q

-

Mobility revenue of

$2.7 million , up 72% q/q - Driving toward profitable Mobility operations by reducing cost of revenue by 17% y/y

-

Expanded global footprint with entry into

Australia market

Media

-

Completion of the first Serie B season as streaming partner generating

$6 million over the season - Amazon Prime Video integration with Helbiz Live

-

Serie B 2022-2023 season available on Helbiz Live on all devices and smart TVs in

Italy

Kitchen

-

Helbiz Kitchen revenue nearly doubled sequentially as awareness builds - Completed administrative steps for ITA AIRWAYS project

Commenting on other achievements in the quarter, Palella said, “Performance in Q2 was solid, with substantial top line growth and clear progress in the micro-mobility business. We expanded into

Palella said, “Even as we drive toward profitable operations in the near-term, we are not losing sight of the massive opportunity in front of us. We are also strengthening the foundation for long-term growth. The due diligence for the transaction with Wheels is underway. Furthermore, last week we announced our entry into taxi hailing, a natural extension of our mobility services. We look forward to sharing more news on these long-term initiatives in the months ahead.”

Profumo said, “Second quarter revenue grew significantly both yearly and sequentially, due to the incremental contribution from Media and Kitchen. Importantly, growth was solid in our core mobility business and we are improving margins as we bring down mobility cost of revenue. Even with our cost-control focus, we are investing effectively and efficiently in talent, advertising, marketing, and R&D to sustain our pace of expansion.”

Profumo said, “To fund our multiple growth opportunities, we raised another

Conference Call Details

What: 2022 Q2 Results

When:

Time:

Where:

International: +1 (646) 307-1963

Conference ID: 4146974

Replay Available: https://investors.helbiz.com/

About

Forward-Looking Statements

Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from the Company’s expectations or projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: (i) the failure to meet projected development and production targets; (ii) changes in applicable laws or regulations;(iii) the affect of the COVID-19 pandemic on the Company and its current or intended markets; and (iv) other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the

|

|

||||||||

|

Condensed Consolidated Balance Sheets |

||||||||

|

(in thousands, except share and per share data) |

||||||||

|

(unaudited) |

||||||||

|

|

|

|

|

|

|

|

||

|

|

|

2022 |

|

|

2021 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,480 |

|

|

$ |

21,143 |

|

|

Accounts receivables |

|

|

1,788 |

|

|

|

451 |

|

|

Contract assets – Media rights |

|

|

1,806 |

|

|

|

2,758 |

|

|

VAT receivables |

|

|

2,843 |

|

|

|

2,992 |

|

|

Prepaid and other current assets |

|

|

4,458 |

|

|

|

4,681 |

|

|

Total current assets |

|

|

13,375 |

|

|

|

32,025 |

|

|

Property, equipment and deposits, net |

|

|

11,234 |

|

|

|

7,616 |

|

|

|

|

|

9,791 |

|

|

|

10,696 |

|

|

Intangible assets, net |

|

|

1,493 |

|

|

|

2,075 |

|

|

Other assets |

|

|

1,539 |

|

|

|

1,212 |

|

|

TOTAL ASSETS |

|

$ |

37,433 |

|

|

$ |

53,623 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Account payables |

|

$ |

14,182 |

|

|

$ |

10,536 |

|

|

Accrued expenses and other current liabilities |

|

|

4,000 |

|

|

|

3,806 |

|

|

Deferred revenues |

|

|

3,651 |

|

|

|

1,585 |

|

|

Warrant liabilities |

|

|

210 |

|

|

|

1,596 |

|

|

Short term financial liabilities and capital leases, net |

|

|

30,597 |

|

|

|

25,473 |

|

|

Total current Liabilities |

|

|

52,640 |

|

|

|

42,996 |

|

|

Other non-current liabilities |

|

|

502 |

|

|

|

419 |

|

|

Non-current financial liabilities, net |

|

|

17,557 |

|

|

|

18,057 |

|

|

TOTAL LIABILITIES |

|

|

70,699 |

|

|

|

61,472 |

|

|

Commitments and contingencies |

|

|

(A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

|

Preferred stock, |

|

|

— |

|

|

|

— |

|

|

Class A Common stock, |

|

|

114,888 |

|

|

|

101,454 |

|

|

Class |

|

|

— |

|

|

|

— |

|

|

Accumulated other comprehensive (loss) income |

|

|

(1,150 |

) |

|

|

(621 |

) |

|

Accumulated deficit |

|

|

(147,004 |

) |

|

|

(108,682 |

) |

|

Total Stockholders’ deficit |

|

|

(33,266 |

) |

|

|

(7,849 |

) |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

37,433 |

|

|

|

53,623 |

|

(A) Commitments and Contingencies

Leases

The Company entered into various non-cancellable operating lease agreements for office facilities, e-mopeds leases, corporate vehicles’ licensing, and corporate housing entered into by the Company with lease periods expiring through 2024. These agreements require the payment of certain operating expenses, such as non-refundable taxes, repairs and insurance and contain renewal and escalation clauses. The terms of the leases provide for payments on a monthly basis and sometimes on a graduated scale. The Company recognizes rent expense on a straight-line basis over the lease period and has accrued for rent expense incurred but not paid. Lease expenses under operating leases were

Additionally, the Company entered into various non-cancellable capital lease agreements for 3,750 eScooters and R&D equipment with financial institutions. The capital lease agreements included within Financial liabilities on the condensed consolidated balance sheet as of

Lease expenses under capital leases were accounted as interest expenses for

|

|

Operating leases |

Capital leases |

||

|

Year ending |

|

|

||

|

2022 |

895 |

2,193 |

||

|

2023 |

588 |

777 |

||

|

2024 |

124 |

60 |

||

|

Thereafter |

41 |

15 |

||

|

Total minimum lease payments |

1,648 |

3,045 |

||

|

Less: Amounts representing interest not yet incurred |

|

252 |

||

|

Present value of capital lease obligations |

|

2,792 |

||

|

Less: Current portion |

|

2,701 |

||

|

Long-term portion of capital lease obligations |

|

91 |

Litigation

From time to time, the Company may become involved in legal proceedings arising in the ordinary course of business. There are currently no material legal proceedings against the Company, and the Company is not aware of investigations being conducted by a governmental entity into the Company. The Company does not disclose litigation with a remote possibility of an unfavorable outcome.

|

|

||||||||||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive Loss |

||||||||||||||||

|

(in thousands, except share and per share data) |

||||||||||||||||

|

(unaudited) |

||||||||||||||||

|

Three Months Ended |

|

Six Months Ended |

||||||||||||||

|

2022 |

|

2021 |

|

2022 |

|

2021 |

||||||||||

| Revenue |

$ |

4,358 |

|

$ |

2,982 |

|

$ |

7,670 |

|

$ |

3,997 |

|

||||

| Operating expenses: |

|

|

|

|

||||||||||||

| Cost of revenue (B) |

|

10,267 |

|

|

6,073 |

|

|

21,606 |

|

|

10,577 |

|

||||

| General and administrative (B) |

|

6,436 |

|

|

2,638 |

|

|

13,115 |

|

|

6,592 |

|

||||

| Sales and marketing (B) |

|

3,415 |

|

|

1,275 |

|

|

6,013 |

|

|

2,408 |

|

||||

| Research and development (B) |

|

638 |

|

|

588 |

|

|

1,382 |

|

|

1,164 |

|

||||

| Total operating expenses |

|

20,756 |

|

|

10,574 |

|

|

42,116 |

|

|

20,741 |

|

||||

|

|

|

|

|

|||||||||||||

| Loss from operations |

|

(16,398 |

) |

|

(7,592 |

) |

|

(34,447 |

) |

|

(16,744 |

) |

||||

|

|

|

|

|

|||||||||||||

| Non-operating income (expenses), net |

|

|

|

|

||||||||||||

| Interest expense, net |

|

(1,512 |

) |

|

(566 |

) |

|

(3,492 |

) |

|

(1,064 |

) |

||||

| Gain (loss) on extinguishment of debts |

|

(2,065 |

) |

|

— |

|

|

(2,065 |

) |

|

— |

|

||||

| Change in fair value of warrant liabilities |

|

441 |

|

|

— |

|

|

1,386 |

|

|

(4,127 |

) |

||||

| Other income (expenses), net |

|

(199 |

) |

|

12 |

|

|

(507 |

) |

|

(260 |

) |

||||

| Total non-operating income (expenses), net |

|

(3,335 |

) |

|

(554 |

) |

|

(4,679 |

) |

|

(5,452 |

) |

||||

|

|

|

|

|

|||||||||||||

| Income Taxes |

|

(7 |

) |

|

(18 |

) |

|

(12 |

) |

|

(33 |

) |

||||

| Net loss |

$ |

(19,740 |

) |

$ |

(8,164 |

) |

$ |

(39,137 |

) |

$ |

(22,229 |

) |

||||

|

|

|

|

|

|||||||||||||

| Deemed Dividends and Deemed Dividends equivalents |

$ |

— |

|

$ |

(37 |

) |

$ |

— |

|

$ |

(72 |

) |

||||

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to common stockholders |

$ |

(19,740 |

) |

$ |

(8,201 |

) |

$ |

(39,137 |

) |

$ |

(22,301 |

) |

||||

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to common stockholders, basic and diluted |

$ |

(0.57 |

) |

$ |

(0.36 |

) |

$ |

(1.21 |

) |

$ |

(1.01 |

) |

||||

|

|

|

|

|

|||||||||||||

| Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted |

|

34,737,852 |

|

|

22,666,617 |

|

|

32,438,971 |

|

|

22,134,945 |

|

||||

|

|

|

|

|

|||||||||||||

| Net loss |

|

(19,740 |

) |

|

(8,164 |

) |

|

(39,137 |

) |

|

(22,229 |

) |

||||

|

|

|

|

|

|||||||||||||

| Other comprehensive (loss) income, net of tax: |

|

|

|

|

||||||||||||

| Changes in foreign currency translation adjustments |

$ |

(206 |

) |

$ |

(46 |

) |

$ |

(529 |

) |

$ |

(39 |

) |

||||

|

|

|

|

|

|||||||||||||

| Net loss and comprehensive income, excluded Deemed Dividends and Deemed Dividends equivalents |

$ |

(19,946 |

) |

$ |

(8,210 |

) |

$ |

(39,666 |

) |

$ |

(22,268 |

) |

||||

(B) Includes stock-based compensation for employees and services received, as follows

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|||||

|

Stock-based compensation |

|

|

|

|

|

|

|

|

||||

|

Cost of revenue |

$ |

2 |

$ |

5 |

$ |

12 |

$ |

17 |

||||

|

General and administrative |

|

804 |

|

423 |

|

1,799 |

|

1,593 |

||||

|

Sales and marketing |

|

161 |

|

47 |

|

343 |

|

214 |

||||

|

Research and development |

|

34 |

|

71 |

|

98 |

|

307 |

||||

|

Total Stock-based compensation expenses |

$ |

1,001 |

$ |

546 |

$ |

2,252 |

$ |

2,131 |

||||

|

|

||||||||

|

Condensed Consolidated Statements of Cash Flows |

||||||||

|

(in thousands, except share and per share data) |

||||||||

|

(unaudited) |

||||||||

|

|

|

Six months ended |

||||||

|

|

|

2022 |

|

2021 |

||||

|

Operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(39,137 |

) |

|

$ |

(22,229 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,661 |

|

|

|

3,331 |

|

|

Loss on disposal of assets |

|

|

116 |

|

|

|

238 |

|

|

Non-cash interest expenses and amortization of debt discount |

|

|

2,971 |

|

|

|

509 |

|

|

Change in fair value of warrant liabilities |

|

|

(1,386 |

) |

|

|

4,128 |

|

|

Change in fair value of accounts payables |

|

|

(304 |

) |

|

|

— |

|

|

(Gain) or Loss on extinguishment of debts |

|

|

2,065 |

|

|

|

— |

|

|

Share-based compensation |

|

|

2,252 |

|

|

|

2,131 |

|

|

Other non-cash items related to licensing |

|

|

— |

|

|

|

748 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid and other current assets |

|

|

2,617 |

|

|

|

(38 |

) |

|

Security deposits |

|

|

(5 |

) |

|

|

22 |

|

|

Accounts receivables |

|

|

(1,337 |

) |

|

|

(360 |

) |

|

Accounts payables |

|

|

3,935 |

|

|

|

(196 |

) |

|

Accrued expenses and other current liabilities |

|

|

2,263 |

|

|

|

1,240 |

|

|

Other non-current liabilities |

|

|

83 |

|

|

|

(137 |

) |

|

Net cash used in operating activities |

|

|

(23,206 |

) |

|

|

(10,613 |

) |

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property, equipment, and deposits |

|

|

(3,586 |

) |

|

|

(4,913 |

) |

|

Deposit for Letter of Intent |

|

|

(1,000 |

) |

|

|

|

|

|

Purchase of intangible assets |

|

|

(117 |

) |

|

|

(308 |

) |

|

Acquisition of business, net of cash acquired |

|

|

— |

|

|

|

(1,987 |

) |

|

Net cash used in investing activities |

|

|

(4,703 |

) |

|

|

(7,208 |

) |

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of financial liabilities, net |

|

|

10,248 |

|

|

|

18,156 |

|

|

Repayment of financial liabilities |

|

|

(1,495 |

) |

|

|

(2,505 |

) |

|

Proceeds from issuance of financial liabilities, due to related party - Officer |

|

|

380 |

|

|

|

2,010 |

|

|

Proceeds from settlement of Subscription receivables |

|

|

— |

|

|

|

4,033 |

|

|

Proceeds from sale of Class A common shares, net |

|

|

— |

|

|

|

955 |

|

|

Payments of offering costs and underwriting discounts and commissions |

|

|

— |

|

|

|

(1,193 |

) |

|

Net cash provided by financing activities |

|

|

9,133 |

|

|

|

21,456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents, and restricted cash |

|

|

(18,776 |

) |

|

|

3,635 |

|

|

Effect of exchange rate changes |

|

|

306 |

|

|

|

(39 |

) |

|

Net increase (decrease) in cash and cash equivalents, and restricted cash |

|

|

(18,470 |

) |

|

|

3,596 |

|

|

Cash and cash equivalents, and restricted cash, beginning of year |

|

|

21,253 |

|

|

|

790 |

|

|

Cash and cash equivalents, and restricted cash, end of year |

|

$ |

2,783 |

|

|

$ |

4,386 |

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF CASH, CASH EQUIVALENT AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEET |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

2,480 |

|

|

|

4,277 |

|

|

Restricted cash, included in Current assets |

|

|

193 |

|

|

|

— |

|

|

Restricted cash, included in Other assets, non-current |

|

|

110 |

|

|

|

109 |

|

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

517 |

|

|

$ |

556 |

|

|

Income taxes, net of refunds |

|

$ |

12 |

|

|

$ |

2 |

|

|

Non-cash investing & financing activities |

|

|

|

|

|

|

|

|

|

Issuance of Class A common shares – for warrant exercise |

|

$ |

— |

|

|

$ |

10,567 |

|

|

Issuance of Class A common shares – for settlement of lease |

|

|

— |

|

|

|

1,747 |

|

|

Issuance of common stock – MiMoto Smart Mobility S.r.l. Acquisition |

|

|

— |

|

|

|

10,389 |

|

|

Convertible notes converted into common shares |

|

|

14,326 |

|

|

|

— |

|

|

Increasing of Financial liabilities for derecognition of Beneficial conversion features (BCF) - Adoption of ASU 2020-06 |

|

|

3,371 |

|

|

|

— |

|

|

Purchase of vehicles with financing agreement |

|

|

3,328 |

|

|

|

— |

|

|

Prepaid expenses related to D&O insurance, included in Account payable |

|

|

402 |

|

|

|

— |

|

|

Issuance of Warrants - in conjunction with Convertible Notes issuance |

|

|

603 |

|

|

|

— |

|

|

Issuance of common shares – Commitment shares and share based compensation for Convertible Notes issuance |

|

|

695 |

|

|

|

— |

|

Note: For more accompanying notes to the condensed consolidated financial statements above, please refer to the Company’s quarterly report on Form 10-Q filed with

View source version on businesswire.com: https://www.businesswire.com/news/home/20220815005631/en/

For media inquiries:

Head of

press@helbiz.com

+1 (646) 726-2146

For investor inquiries:

gary@blueshirtgroup.com

+1 (323) 240-5796

Source: